Irs 2024 Payment Schedule

Irs 2024 Payment Schedule – The IRS again delays law that would have required Ticketmaster, Venmo, and others to issue 1099-Ks to those with more than $600 in revenue in 2023. . The Internal Revenue Service has announced that income tax brackets taxes you pay from your income. The rates currently are set at 10%, 12%, 22%, 24%, 32%, 35% and 37%. For 2024, the lowest .

Irs 2024 Payment Schedule

Source : thecollegeinvestor.com

IRS Announces 2024 Retirement Plan Contribution, Benefit Limits

Source : www.payroll.org

IRS updates PCORI fee amount for certain payments due in 2024

Source : buck.com

3.11.10 Revenue Receipts | Internal Revenue Service

Source : www.irs.gov

SSI Payment Schedule 2024 Stimulus Checks Dates, How to Apply for

Source : www.incometaxgujarat.org

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

IRS Announces New PCORI Fee for Plan Years Ending Before October 1

Source : www.sequoia.com

Individuals 2 | Internal Revenue Service

Source : www.irs.gov

Legal Alert: IRS Releases PCORI Fee For Plan Years Ending Before

Source : aleragroup.com

IRS Tax Pros on X: “In 2024, businesses that receive $10,000+ in

Source : mobile.twitter.com

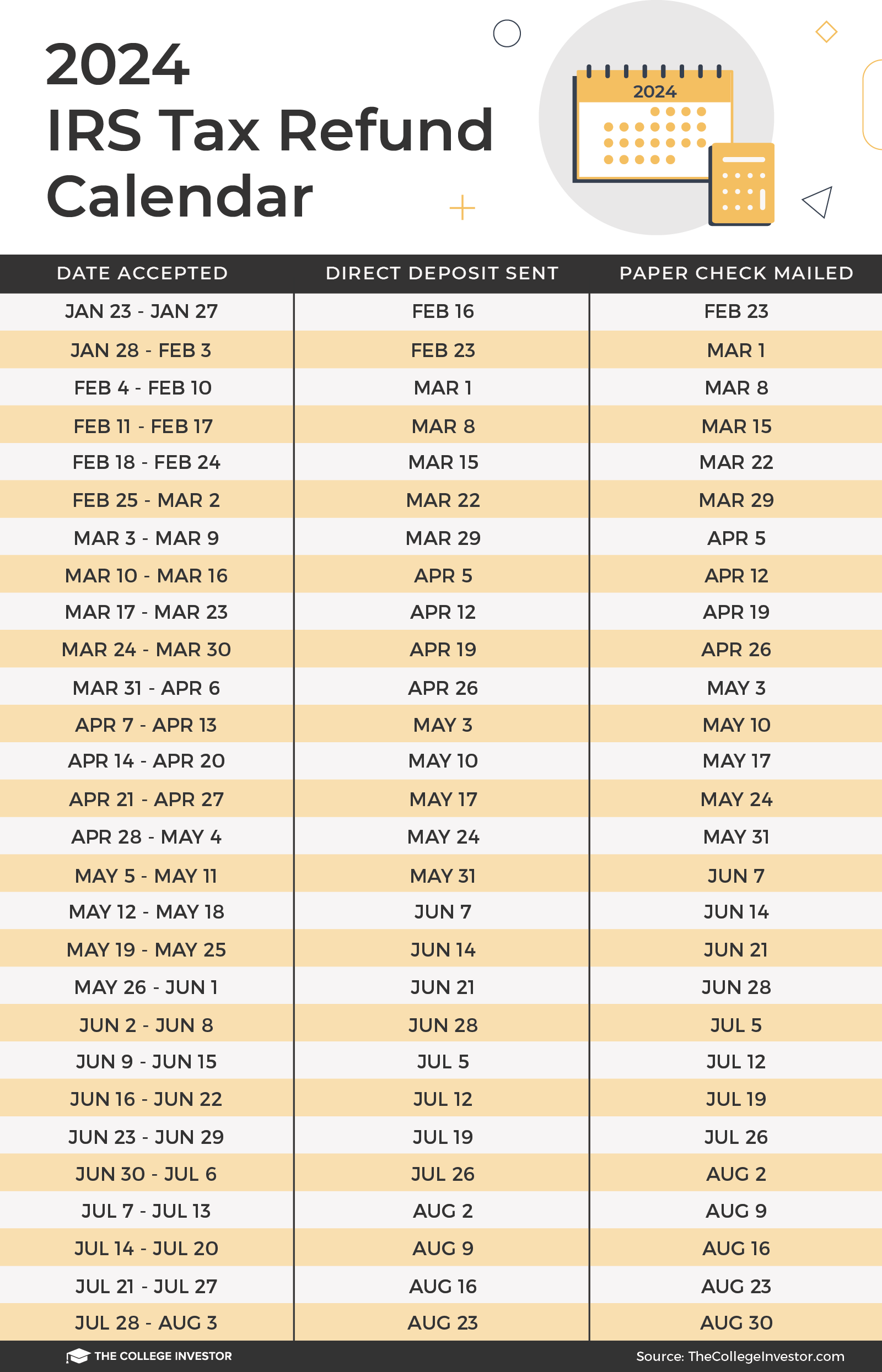

Irs 2024 Payment Schedule When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024: But for 2024, more of your income will fall into lower tax brackets. For instance, in the 2023 tax year single tax filers will pay 10% on their first $11,000 of taxable income. In 2024 . Tax year 2023 will come to a close in at year-end, and you will have until Monday, April 15, 2024 to get your return in. Pay attention to changes where they apply to you The tax brackets and .