Business Mileage Reimbursement 2024

Business Mileage Reimbursement 2024 – To Per Diem or Not to Per Diem There are two basic ways that employees can be reimbursed for business travel direct actual expense reimbursement method. Also, the per diem method cannot cover . One of the primary benefits of calculating mileage reimbursement is the potential for tax deductions. The IRS allows individuals and businesses to deduct expenses related to the use of their personal .

Business Mileage Reimbursement 2024

Source : www.motus.com

What Will the 2024 IRS Mileage Rate Be? | TripLog

Source : triplogmileage.com

2024 IRS Mileage Rate: What Businesses Need to Know

Source : www.motus.com

2024 IRS Standard Mileage Rates (Business, Medical, etc)

Source : mileagepad.com

IRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.com

What Will the 2024 IRS Mileage Rate Be? | TripLog

Source : triplogmileage.com

IRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.com

IRS Announces 2023 2024 Per Diem Rates For Taxpayers Who Travel

Source : www.forbes.com

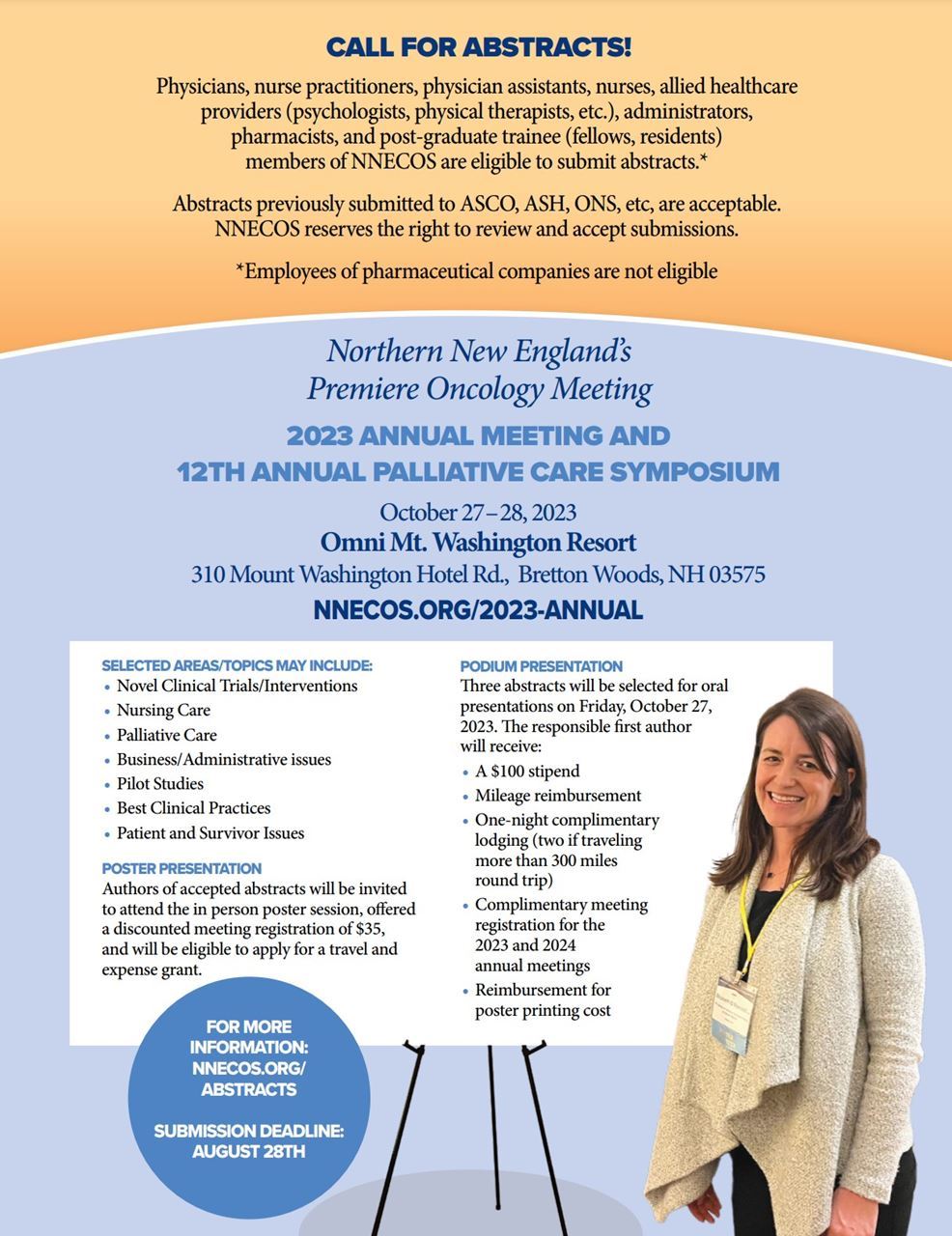

Northern New England Clinical Oncology Society Annual Meeting

Source : www.nnecos.org

IRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.com

Business Mileage Reimbursement 2024 2024 IRS Mileage Rate: What Businesses Need to Know: For the tax year 2024, the rate is expected Employees who use their personal vehicles for business purposes may also be eligible for mileage reimbursement from their employers. . Business and travel expenses should be paid through appropriate buying and paying methods, but, as an employee, you might incur expenses with out-of-pocket funds. You can request reimbursement in .